Halt and Catch Fire? Probably not. The State of the US Venture Capital Market in Early 2020

FEBRUARY 26TH, 2020

In computer engineering, Halt and Catch Fire, known by the assembly mnemonic HCF, is an idiom referring to a computer machine code instruction that causes the computer's central processing unit (CPU) to cease meaningful operation, typically requiring a restart of the computer. Are we witnessing such a restart in the US Venture Capital market after a decade of growth?

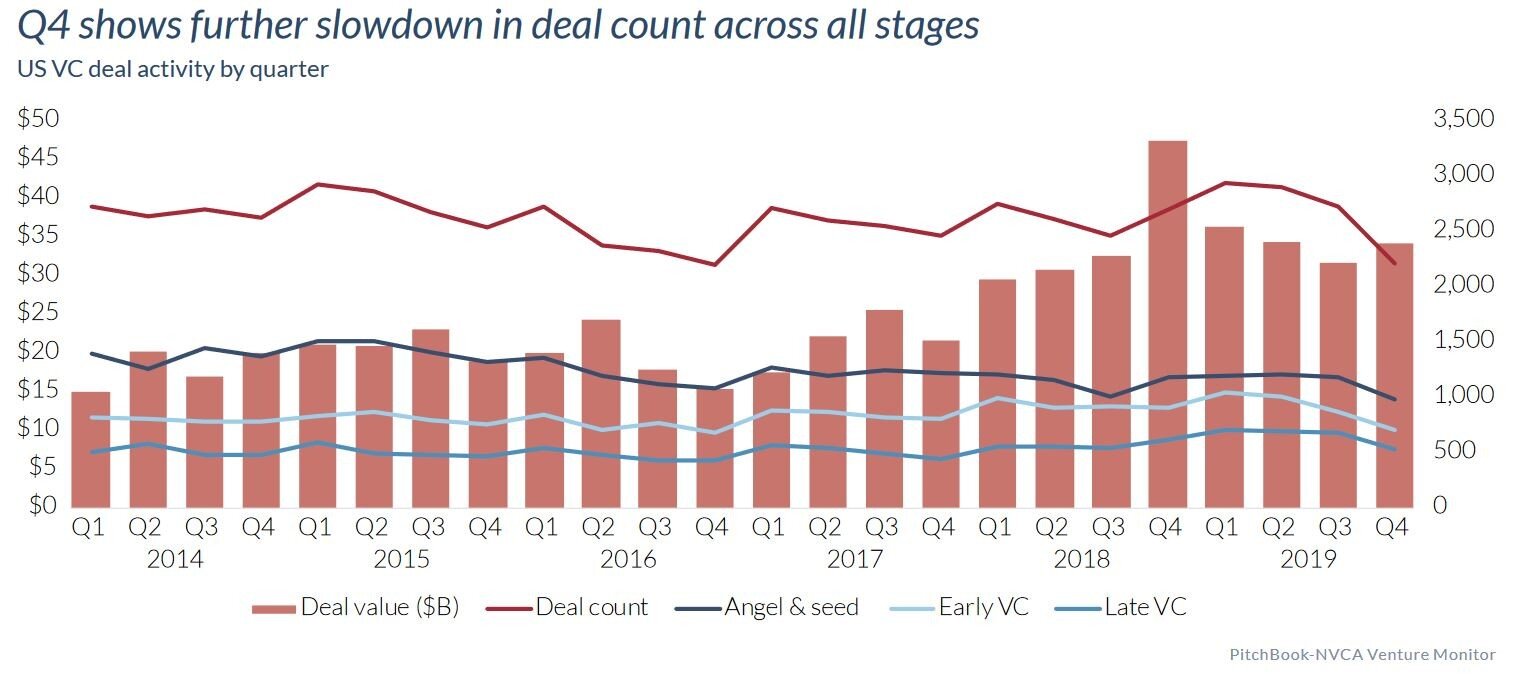

In 2019 the venture industry deployed $136.5 billion in US-based companies, surpassing the $130 billion-mark for the second consecutive year, according to the PitchBook-NVCA Venture Monitor. This market has grown dramatically over the last five years. However, 2019 saw a year-long quarter over quarter slowdown in capital deployment, including in Q4 after accounting for late stage (Soft Bank-esque) deals.

The effect of late round mega deals on total capital deployment can be seen when reviewing the 2019 deal count data, Q4 in particular. We see the a quarter over quarter decline throughout the year, with a steep decline in Q4. It's worth noting here that the Q4 decline may not be as steep as this data suggests, as some of the rounds completed in Q4 haven’t been announced yet. However, a lag in deal announcements will not be enough to reverse the 2019 trend of a reduction in quarterly deal volume throughout the year.

The mean and median round sizes also tell an interesting story. Vast amounts of capital resources available continued to drive growth in deal sizes across all stages. Early stage median round sizes have increased from $2.5 million in 2010 to $6.5 million in 2019. Again, this syncs with the capital deployment and deal count data. The increase in capital deployment (most notably another near-record year for mega-deals at the late stage) has outpaced the decrease in overall deal count, resulting in record capital deployment despite falling deal counts.

During the first two months of 2020 the public bull market continued unabated after an incredible 2019. However, political uncertainty continues to mount, and new geopolitical risks continue to emerge- most recently the risk of a global pandemic. As a result, perhaps the decrease in deal activity throughout 2019 represented the beginnings of more cautiousness in the venture market.

That said, the sentiment in the early-stage entrepreneurial and investor communities continues to be positive and until this changes, I don’t foresee the trendlines deviating materially.

Fred Wilson of USV posted an analysis yesterday calculating the amount of VC capital that can be invested on an annual basis while still generating reasonable returns- meaning a fund needs to generate 2.5x net of fees and carry to the investors. Fees and carry bump that number to 3x gross returns. In order to hit those marks, we would need to see the $20-$30bn invested into the VC asset class five years ago turning into $60-$90bn per year in proceeds to the venture funds today. Not only are we seeing returns in excess of that 3x for the entire ten year period measured by Pitchbook, the aggregate return multiples accelerated for the most recent vintage funds- i.e. an annual average of $25bn was invested into VC funds between 2012 and 2014 and this has translated to an annual average of $161bn exit value between 2017 and 2019 for a multiple of 6.4x. That data, paired with the ten-year VC exit value trend line suggests that the max that can be invested in VC funds on an annual basis today and still generate reasonable returns is closer to $100bn, well north of the $46bn invested in 2019.

In addition, over the past two decades Venture Capital has become an institutional pillar of the US economy. The only way that pillar falters materially is if the macro-economy itself falters in a material way. Despite the risk of potential black swans on the horizon, a material macro-level falter seems unlikely given the ever improving health of underlying economic data- wages are growning, GDP is stable (while still tepid), unemployment is low, housing data is promising, etc. Because of this, pending a black swan, I don't think we're witnessing a Halt and Catch Fire moment for the US Venture Capital industry.

The important question VCs and entrepreneurs must ask, is what to do in light of the market data and growing macro-level uncertainty. That answer never changes: build fundamentally strong businesses and finance them when you can at reasonable valuations so they can grow sustainably over time.