The Crypto J-Curve

FEBRUARY 15TH, 2018

As the cryptoasset markets develop we’ll continue to see many booms and busts. This cycle is normal for any emerging technology. We saw a similar pattern with the emergence of the internet, the dot-com crash, and the resurgence of web 2.0 (Facebook, Dropbox, Spotify, Netflix, Uber etc.). Markets adapt much faster these days. Crypto went from the “Netscape Moment” to the “Dotcom Bubble” to the “Crash of 2000” in months. I believe we will now see tremendous value creation in crypto, similar to the value creation we saw in web 2.0 after the dot-com crash.

Bitcoin has been through a few boom-bust cycles already, most recently in late 2013, when bitcoin first broke $1,000, followed by the crash that lasted until January 2015 when bitcoin found its bottom at $175. The current bust cycle saw bitcoin approach $20,000 in mid-December 2018, and crash to $6,000 in early-February 2018.

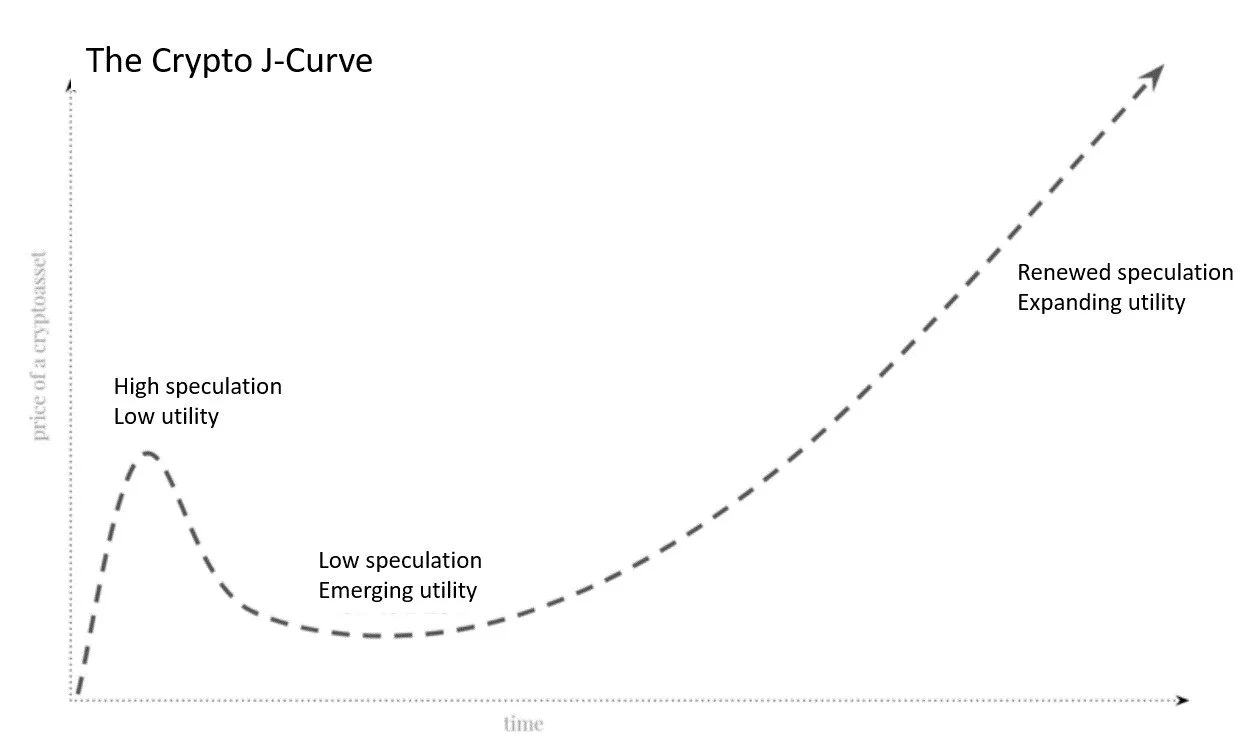

In venture capital, the J-curve refers to a portfolio’s cash flows. A similar pattern can be seen relative to the crypto markets. The crypto J-curve stems from how the market values a cryptoasset over time.

Upon an ICO, or upon an initial listing on a major exchange, enthusiasm for a cryptoasset is high, and typically continues to boom for a while. In this period, the utility value of the cryptoasset is usually minimal, or non-existent. This initial period of high enthusiasm is the first small peak of a crypto J-curve, as shown below. A similar trend can be observed when looking at the cryptoasset class at the macro level, and we may have just experienced its first small peak.

As with any early stage tech company, as a crypto project progresses and attempts to scale, the team and technology encounter unforeseen challenges. When these challenges occur, market enthusiasm busts, and the price of the asset decreases. When challenges are encountered, speculators exit the market, and with speculative hype gone, and little current utility value, the price of the cryptoasset gets crushed.

However, a dedicated team will keep their head down and remain indifferent to the market price of the cryptoasset. As a result, the asset's utility improves and more users trickle in, marking the beginning of ascent from the bottom of a J-curve.

The curve will start to steepen as the market becomes aware of the growing utility of the asset, speculators flow back into the asset (or asset class), and driving up the price. This is why a crypto J-curve steepens in its later stages.What happens next remains to be seen. If speculators quickly outpace the growth of an assets utility gains, another bubble will be created. If an the market is rational and an equilibrium of speculation and utility is established, the stable appreciation of the asset (or asset class) would follow- similar to the appreciation of the NASDAQ we've seen since 2000 (2008 aside). Alternatively, the J-curve cycle could play out again and again. However, even under this cyclical scenario, there will be tremendous value creation. Each prior J-curve peak will pale in comparison to the next, creating significant value creation over the long-term.

At this point, a full J-curve cycle has played out. Cryptoassets have gone from being primarily composed of speculative value, encountered scaling challenges, and have fallen to the bottom of the J-curve. Now it is up to the crypto teams to develop their products, demonstrate utility and attract renewed investor interest.

I've tried to apply the crypto J-curve concept to the recent crash, but I'd like to thank Chris Burniske and his colleagues for introducing me to the crypto J-curve concept in the first place.